Why insurance companies should practice content marketing

Last updated on May 2, 2022 at 16:08 PM.“Clearly, an increasing number of brands are becoming aware of the fact that they cannot afford to watch the content game from the sidelines,” says Kim Larson, Head of Google BrandLab. This is why we are examining the value companies within specific industries place on content marketing in our Sector Review. Do they bank on content that is useful and relevant for their target group in order to attract their attention? Following our Sector Review of one-stop financial services distributors, we will now focus on insurance companies. How do they integrate content marketing into their marketing strategy?

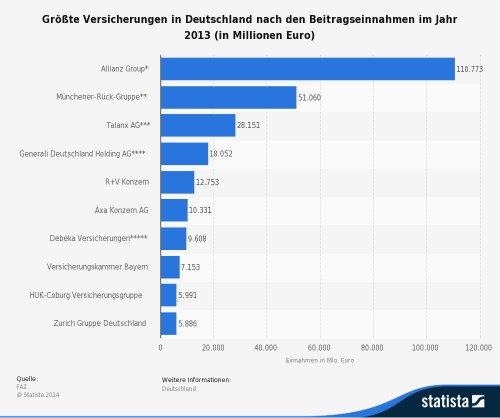

Allianz Group is taking the top spot amongst the largest insurance providers in Germany. (Source: FAZ according to Statista)

In order to answer these questions, we’ll review the ten largest insurance companies in Germany and examine their content marketing activities. This will give us an overview of the content marketing found within this sector, while highlighting the options available to insurance companies to position themselves on the same level, or ahead of their competitors.

Who practices content marketing?

Similar to one-stop financial services providers, insurance companies are facing the problem of providing an abstract service: Insurance products are difficult to illustrate. This may well explain why most of the companies we analysed focus on text-based content - including blogs, customer magazines and advice sections.

The majority of the insurance companies provide such offerings. Allianz Germany and Versicherungskammer Bayern publish customer magazines, 1890 and Gesundheit aktuell (Health Now). However, blogs are becoming the norm and are provided by Allianz Germany, ERGO, Generali Versicherungen, R+V Versicherung and HUK COBURG. AXA maintains a blog-like subsite - Das Plus von Axa (Benefits of AXA) - and a Facebook App. The content of these offerings varies between career advice, general advice sections and information about insurance products. Some insurance companies also provide information pages on their own websites. An example for this is the Ratgeber (Guide) by Zurich. HDI Versicherung and Debeka fail to offer any comparable and attractive content.

Content marketing via social networks

The abstract character of the insurance market accounts for the low number of companies that maintain a profile on image based social networks, such as Instagram. Yet, this handicap translates into an opportunity for realising strategies in image-focused social networks without competitive pressures. At the moment, only Allianz Germany is actively engaged on Instagram and Pinterest. Insurance providers like Versicherungskammer Bayern mainly post image content on Facebook and forego the full potential of this content by failing to re-use it on Instagram.

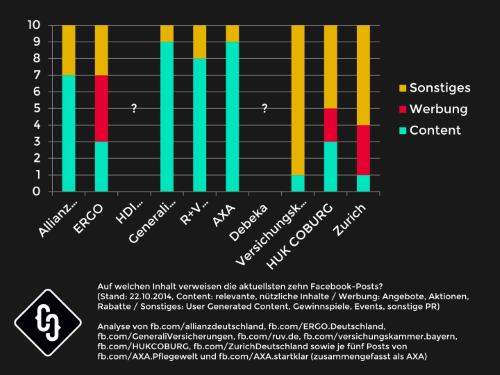

The different companies utilise Facebook for their content marketing to varying degrees. Some insurance companies really focus on content - ranging from their own text-based offers through third party content to newspaper articles. ERGO, HUK COBURG and Zurich, on the other hand, use their pages for advertising purposes. HDI Versicherung and Debeka have no dedicated Facebook account.

With the exception of HDI Versicherung, all companies analysed are also active on YouTube. Here, users will find a mixture of adverts and PR. Explanatory videos and useful films only account for a small proportion of the videos - and this includes those in the media centre of Versicherungskammer Bayern. At the moment, video content is merely a sideline for insurance companies and one-stop financial services distributors alike.

6 arguments why insurance companies should practice content marketing

Content marketing in the insurance industry is still in its infant phase and there are numerous reasons, why insurance companies should develop their own strategy.

1. Every single person wants to make provisions and gain assurance. There is a natural interest in information that helps people achieve this. Insurance companies can provide this type of content without having to venture into new and novel subject areas. Any company failing to practice content marketing in this manner as a minimum is throwing away potential.

2. Insurance companies can prove their expertise and create trust through content. Financial crises and scandals have eroded the trust in financial services providers - including insurance companies. By providing useful and relevant content, insurance companies can prove their expertise and build trust in the long-term. Classical advertising or PR tools are not able to achieve that.

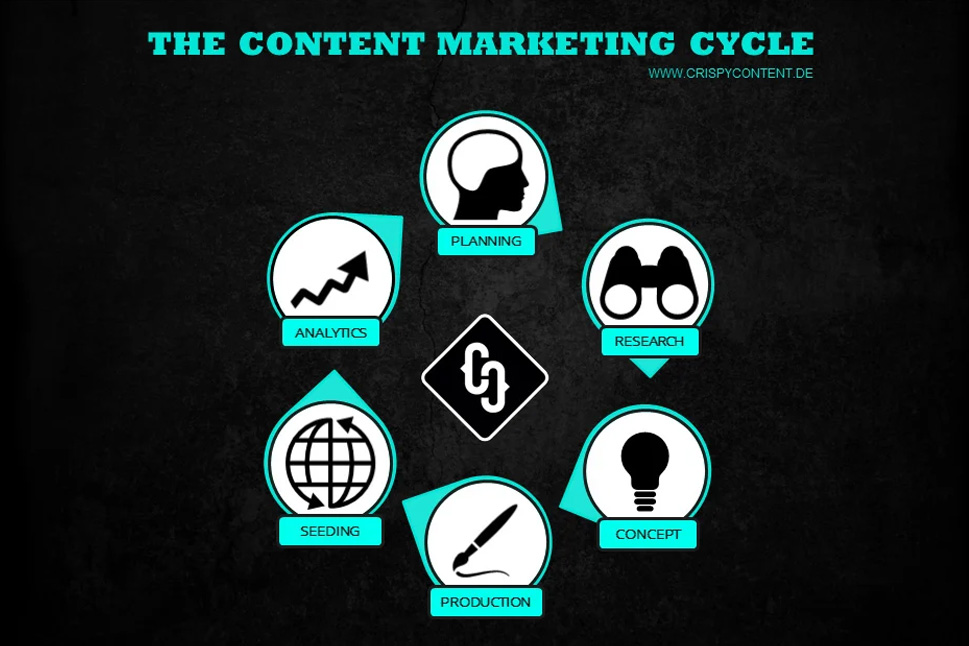

3. Most of the time, content already exists. The analysis has shown that insurance companies tend to maintain subsites with tips, advice and information. This content can be recycled and reused in attractive blogs or customer magazine with relatively low financial and time investment, if a suitable concept is applied. This only leaves two phases in the content marketing cycle: seeding the content in the social channels and analysing its performance.

4. If you don’t join the game, you risk running on empty. Some insurance companies are already playing the content game. Those that don’t and fail to adopt their own content marketing strategy risk losing customers to these competitors.

5. It’s not too late... yet. The financial services market isn’t saturated yet - and this applies to the insurance market as much as to the one-stop financial services providers. In particular, there’s still room at the top in the area of image and video content. Develop your content marketing strategy - And do it now!

6. Content marketing creates synergies. Text-based content contributes towards search engine optimisation. Editors can strategically place keywords in blogs and customer magazines - especially those increasingly important long tail keywords. This will also improve the long-term visibility of the company on Google and the like.

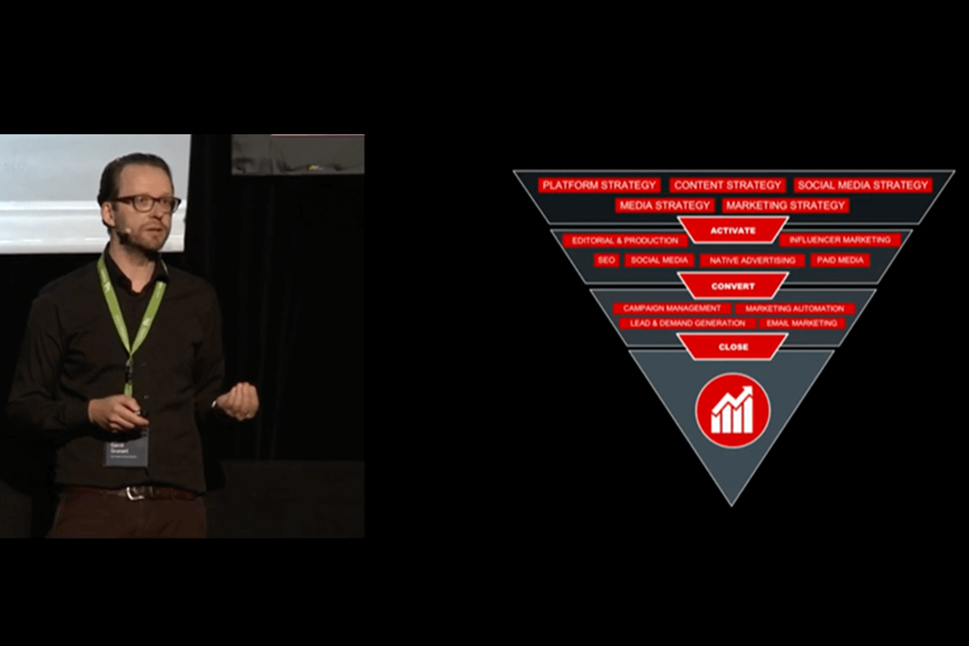

The right content marketing strategy for each insurance company will depend on the company as a whole, its internal objectives and its target group. There’s no one-size-fits-all strategy for all insurance providers. And this is the real challenge. The six arguments listed above show that it’s high time for insurance companies to develop such a strategy - or to engage professionals to do it for them.

Gerrit Grunert

Gerrit Grunert

Gerrit Grunert is the founder and CEO of Crispy Content®. In 2019, he published his book "Methodical Content Marketing" published by Springer Gabler, as well as the series of online courses "Making Content." In his free time, Gerrit is a passionate guitar collector, likes reading books by Stefan Zweig, and listening to music from the day before yesterday.

![[FREE Ebook] Content Marketing Tools Essentials](https://no-cache.hubspot.com/cta/default/463294/02a763e7-df79-4758-ba35-000e19399736.png)